tax break refund status

GTC provides online access and can send notifications such as. Refunds can take six to eight weeks if.

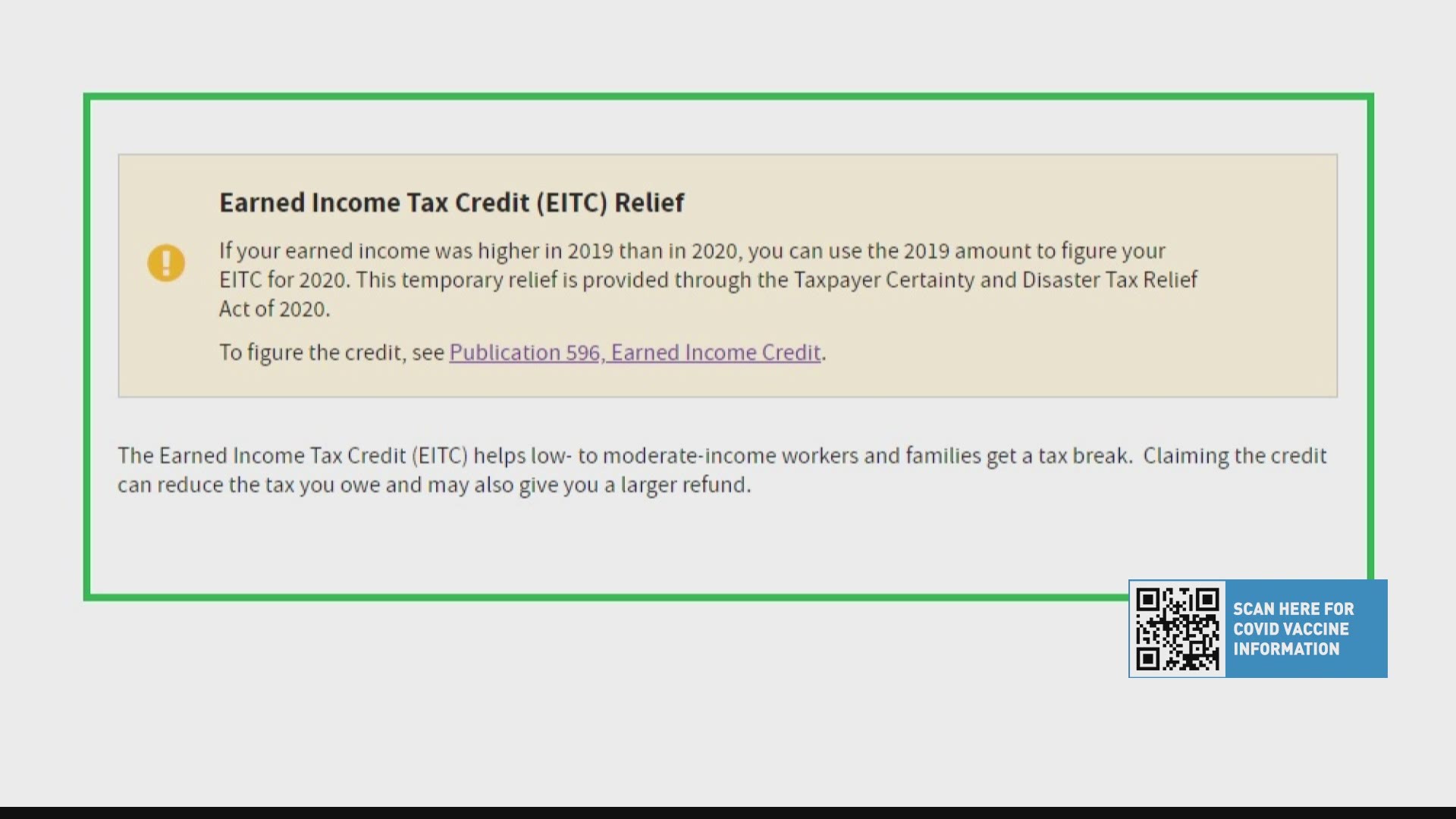

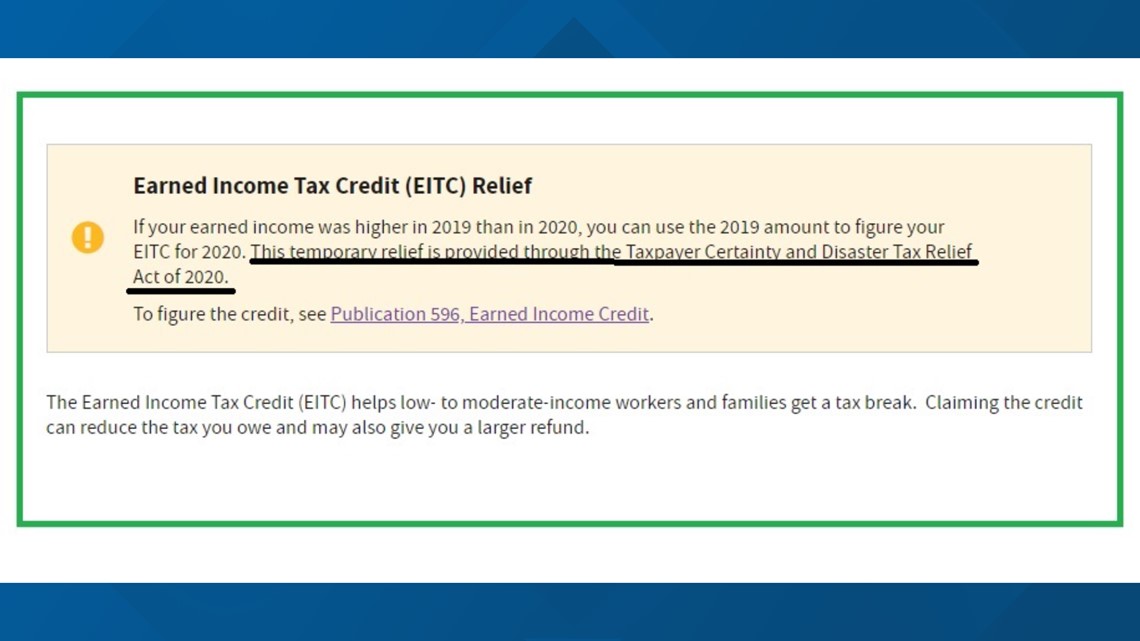

Get A Bigger Refund With The Earned Income Tax Credit Eitc Wfmynews2 Com

You can check your tax refund status on the IRS website through a page called Wheres My Refund.

. Heres a quick recap of what we know. You need three things to check your. Alice Grahns Digital Consumer Reporter.

4million Americans to receive 10200 unemployment tax break refunds this week how to track your payment. 24 hours after e-filing a tax year 2021 return 3 or 4 days after e-filing a tax year 2019 or 2020 return If you filed on paper it could take 6 months or more Updates. Check The Refund Status Through Your Online Tax Account.

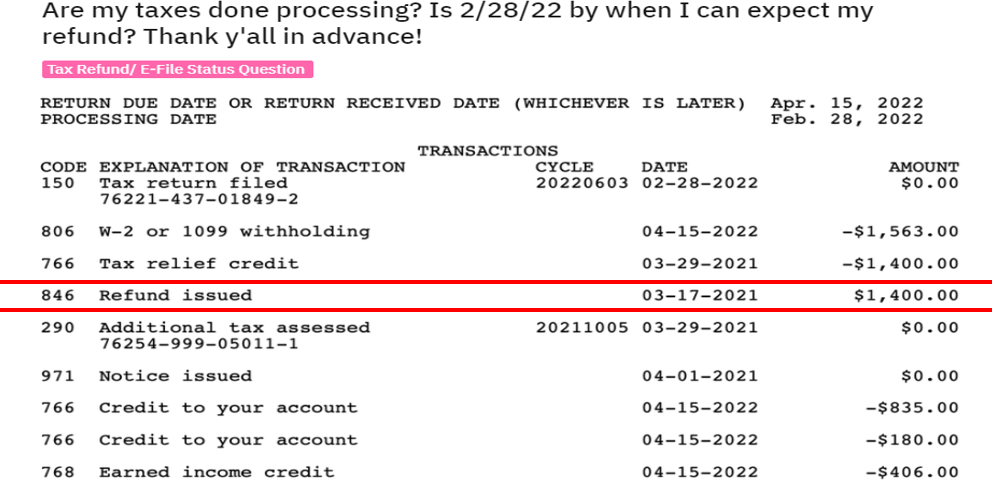

You wont be able to. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Check the status of your refund through an online tax account.

Income Tax Refund Information. Status of paid refund being paid other than. When you contact the IRS be sure to have.

You most likely wouldnt see that until 2024 however. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. 19 with plans to send out 250000 each weekday.

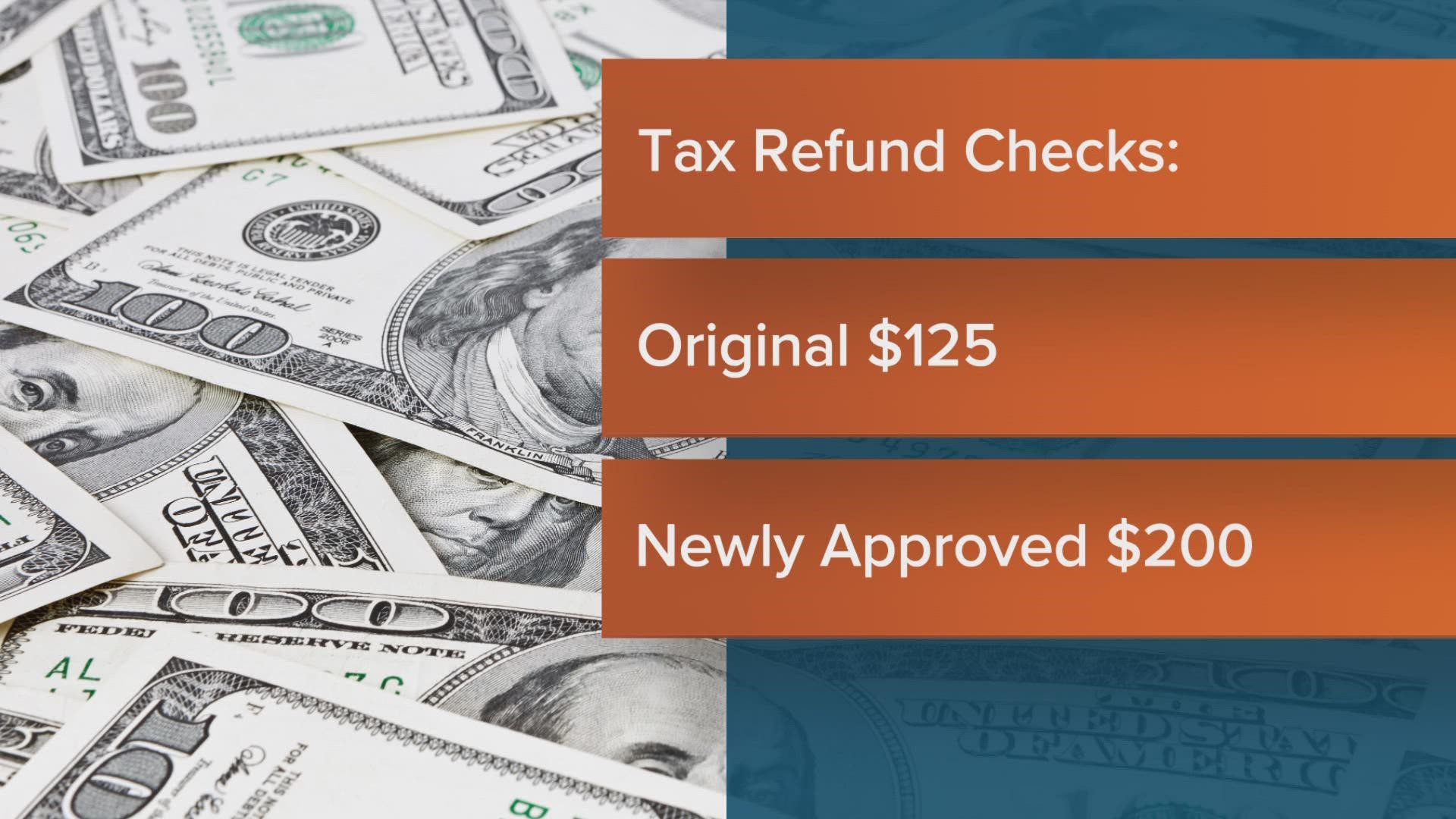

To check the status of your ERTC refund you will need to contact the IRS. If you file your taxes early you dont have to wait until after the tax deadline to get your tax refund. The tax break would as with the refund checks need to be approved by the legislature when they meet again in Jan.

Unemployment tax refund status. Can you track your unemployment tax refund. Check your refund online does not require a login Sign up for Georgia Tax Center GTC account.

Wheres My Tax Refund. You can do this by calling the IRS helpline or by visiting the IRS website. 541 ET Jul 14 2021.

How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who. If the irs determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a check or. The amount of the.

Over the course of the program. The IRS indicates that it issues nine out of 10 refunds within three weeks if you choose direct deposit and youve e-filed your tax return. The unemployment tax break is a special type of refund that allows you to deduct up to 20400 of unemployment benefits from your earnings.

Ways to check your status. People waiting on a payment can check the status of it using the IRS trackers using their Social Security number or Individual Taxpayer Identification Number filing status and. IRS TAX REFUND.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Call our automated refund system 24 hours a day and check the status.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. DO NOT send cash or EMAIL THIS REPORT. 5 most rebates started going out Sept.

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. You also had to file your 2021 Illinois income tax return Form IL-1040 opens in new tab with a claim for the property tax credit on Line 16 and Schedule ICR opens in new. Depending on the complexity of your tax return you could get your tax refund.

For taxpayers who filed their state returns by Sept. The 10200 is the amount of income exclusion for single filers not the amount of.

Here S When You Can Expect Your Indiana Tax Refund Check Wthr Com

Earned Income Tax Credit Eitc Internal Revenue Service

4 Steps From E File To Your Tax Refund The Turbotax Blog

How To Get Maximum Tax Refund If You File Taxes Yourself Parade Entertainment Recipes Health Life Holidays

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Check Your Refund Status Online 24 7

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Where S My Refund Tracking The Status Of Your Tax Refund Nerdwallet

Irs Refund Status How To Check On Your Refund Youtube

Taxes For Teens A Beginner S Guide Taxslayer

Tax Refund Tracker Where S My Tax Refund Jackson Hewitt

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Get A Bigger Refund With The Earned Income Tax Credit Eitc Wfmynews2 Com

Early Tax Refunds Are Up But Some Wonder Why Their Refund Is Smaller

Irsnews On Twitter Need A Copy Of A Tax Return Or Transcript No Need To Call Order It On The Irs Website Https T Co Gkxxy0hhif Https T Co Io6lonnjr0 Twitter

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest